If you're looking to diversify your retirement portfolio with Rocket Dollar but don’t know whether it is good or not, you're in the right place. In this article, we'll address all the questions to help you decide if Rocket Dollar is suitable for your investment needs.

In this review, we'll explore Rocket Dollar's account types, features, investment choices, security measures, fees, refund policy, and customer support. We also provide their advantages and drawbacks to assist you in making an informed decision.

What is Rocket Dollar?

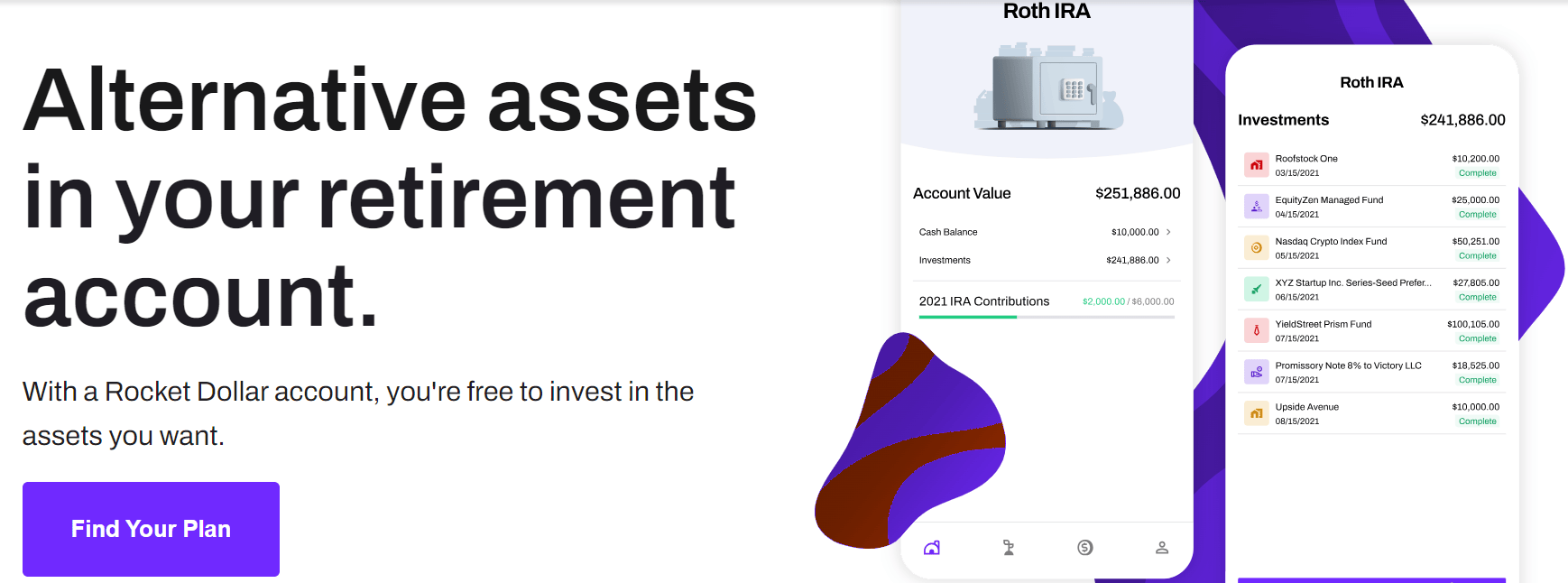

Rocket Dollar is a self-directed IRA custodian that provides retail investors with a unique opportunity to explore alternative asset investments. While many traditional retirement accounts limit you to stocks and ETFs, Rocket Dollar offers a diverse range of investment options, including real estate, cryptocurrency, precious metals, peer-to-peer loans, small businesses, startups, and private equity. What sets Rocket Dollar apart is its "Bring Your Own Deal" (BYOD) feature, which enables you to invest in assets not currently available on the platform.

A self-directed Rocket Dollar account opens the door to a world of alternative investment opportunities that go beyond conventional stock and ETF choices. With Rocket Dollar, you can explore investment options like crowdfunding, startup lending, and real estate rental income. This flexibility empowers you to diversify your portfolio in exciting and potentially lucrative ways.

Rocket Dollar review

In this part review, we will look at the different account types, features, investment options, security, fees, and refund policies that Rocket Dollar offers to help you decide if Rocket Dollar is the best choice for your retirement goals.

Rocket Dollar account types

Rocket Dollar offers two primary types of self-directed retirement accounts:

- Self-Directed IRA: This account allows you to save for retirement in a tax-deferred environment with no income limits. It's available in two main subtypes:

- Traditional IRA: Ideal for those who want to defer taxes on their retirement savings.

- Roth IRA: Fund this account with after-tax dollars and enjoy tax-free qualified withdrawals.

- Self-Directed Solo 401(k): Tailored for self-employed individuals, the Solo 401(k) offers high contribution limits and unparalleled flexibility in managing your retirement savings.

Rocket Dollar features

With a range of unique features, Rocket Dollar distinguishes itself from other companies:

Rocket Dollar website

- Checkbook Control: With Rocket Dollar, you have the power to access your funds and make investments by writing a check or using a debit card directly from your account. This level of control provides greater convenience and speed compared to traditional custodial services.

- Online Dashboard: Managing your account and tracking your investments is made easy with Rocket Dollar's user-friendly online dashboard. You can check your account balance, review transactions, access statements, and retrieve documents at your convenience.

- Support Team: Rocket Dollar's dedicated support team is available to assist you through phone, email, or chat. They can help you with various aspects of your account, including its setup, funding, and investment. You can also rely on them for expert guidance and answers to any questions you might have along the way.

- Educational Resources: Rocket Dollar offers a wealth of educational resources on its website, including blogs, webinars, podcasts, guides, and FAQs. These materials are designed to help you gain a deeper understanding of self-directed investing, alternative assets, tax regulations, and best practices. By leveraging these resources, you can make more informed investment decisions.

Rocket Dollar investment options

The company distinguishes itself with an impressive range of investment opportunities that expand far beyond the offerings of traditional retirement accounts. Within the Rocket Dollar platform, investors have access to an array of exciting investment options:

- Real Estate: Rocket Dollar paves the way for real estate investments, encompassing a diverse spectrum, including individual residential properties, multi-unit residential complexes, real estate syndication deals, Real Estate Investment Trusts (REITs), and participation in real estate projects through crowdfunding platforms.

- Cryptocurrency: For enthusiasts of the dynamic world of cryptocurrencies, Rocket Dollar permits the buying, selling, and holding of various digital assets, such as Bitcoin, Ethereum, Litecoin, and more. Security is paramount, and users can opt for reputable cryptocurrency platforms like Coinbase or Gemini to securely store their crypto holdings.

- Precious Metals: Portfolio diversification is made easy with the option to invest in precious metals like gold, silver, platinum, and palladium. Rocket Dollar facilitates the purchase and secure storage of these valuable assets through trusted dealers such as APMEX or JM Bullion.

- Private Equity: Investors intrigued by private companies not listed on public exchanges can delve into the world of private equity through Rocket Dollar. The platform also provides opportunities to access pre-IPO investments via platforms like EquityZen or SharesPost.

Rocket Dollar security

Regarding security, Rocket Dollar places a premium on protecting your account and information. Several essential security measures are in place:

- Encryption: To prevent unauthorized access or interception, Rocket Dollar utilizes SSL technology to encrypt your data effectively.

- Authentication: Prior to accessing your account online or through phone support, Rocket Dollar mandates the verification of your identity and login credentials.

- Custody: Your funds are held securely in an FDIC-insured bank account, thanks to Rocket Dollar's partnership with Kingdom Trust, a highly reputable custodian.

- Compliance: Rocket Dollar is committed to adhering to IRS rules and regulations that govern self-directed retirement accounts. This ensures that you stay on the right side of the law, avoiding any prohibited transactions or potential penalties.

Rocket Dollar fees

When it comes to fees, Rocket Dollar maintains a transparent fee structure based on your selected subscription tier:

- Silver Tier: This tier involves a $360 setup fee and a monthly fee of $15.

- Gold Tier: The Gold tier encompasses a setup fee of $600 and a monthly fee of $30.

The fees you pay are contingent on your chosen tier, and both tiers grant access to Rocket Dollar's suite of features and investment opportunities. Rocket Dollar aims to provide investors with a secure and user-friendly platform to explore a wide range of investment options while keeping costs transparent and accessible.

Rocket Dollar refund policy

If you find that you're not completely satisfied with your experience, you can request a refund. To do so, simply send an email to Rocket Dollar Support, accessible via your dashboard, within 30 days of payment. This email serves as an electronic record of your request to discontinue service.

Rocket Dollar will refund the full amount paid, minus any hard cost fees incurred by the company. While Rocket Dollar endeavors to process your request promptly, it's important to note that some custodians may take 5-10 business days to receive and acknowledge the funds.

Rocket Dollar pros and cons

Here strengths and weaknesses of this platform that we have summarized. Before you decide to use this platform, carefully consider the following to ensure it aligns with your investment goals and preferences.

Rocket Dollar pros and cons

|

Pros |

Cons |

|

|

Who is Rocket Dollar best for?

Rocket Dollar is best for investors looking for a broader range of alternative assets in their retirement accounts. It gives you the most alternative assets and account types choices compared to its competitors.

However, they are not ideal for investors who prefer to invest in traditional assets, such as stocks, bonds, and mutual funds, have a low-risk tolerance or a short time horizon, and want to avoid paying any upfront or ongoing fees. Additionally, for individuals new to self-directed investing or those who require comprehensive guidance and professional advice, Rocket Dollar may not be the platform of choice.

Rocket Dollar discount code

For potential users looking for a Rocket Dollar discount code, it's advisable to visit the official Rocket Dollar website or keep an eye out for any promotional offers that may be periodically available. The company may occasionally offer discounts or promotions to new customers, so it's worth checking their website for the latest deals.

Besides, don’t forget to check on coupon sites such as CouponATime if you want to make the most out of your purchasing experience. They provide coupon codes for a lot of stores including Rocket Dollar. You can visit their site to see the full discount list or grab a Rocket Dollar promo code here as we have picked the most saving codes:

Rocket Dollar competitors

While Rocket Dollar is a prominent player in the self-directed retirement account space, other companies provide similar services. Here are a few notable competitors:

- Alto IRA: Alto IRA allows investors to access alternative assets with their IRA. It offers various investment partners, including AngelList, Wefunder, and Masterworks. The platform charges a $49 setup fee and a $25 monthly fee for its basic plan.

- Broad Financial: Broad Financial specializes in self-directed IRAs and Solo 401(k)s, enabling investment in diverse asset classes like real estate, cryptocurrency, and precious metals. They charge a $1,295 setup fee and a $175 annual fee for their IRA plan.

- Equity Trust: Equity Trust is a custodian that offers self-directed IRAs and Solo 401(k)s, providing investment options in areas such as real estate, private equity, and notes. A $50 setup fee and an annual fee based on your account value and number of investments.

Each of these competitors has its unique features and fee structures, so it's advisable to compare them to find the one that aligns best with your investment goals and preferences.

Conclusion

Rocket Dollar is a versatile platform that empowers investors to take control of their retirement savings and explore alternative investment options. With various account types, features, and investment opportunities, it caters to a diverse range of investors. Rocket Dollar is also suitable for investors who are comfortable with self-directed investing, have some knowledge and experience with alternative assets, and are willing to do their own due diligence and research. Start investing today with Rocket Dollar!